You can: |

Help save money by avoiding check fees

|

Fund cards in real-time, potentially enabling instant use

|

Reinforce your brand by incorporating it into the card design

|

Offer a simple, convenient payments experience

|

|---|---|---|---|---|

Your payees can3: |

Access funds in real-time with a digital card

|

Order a physical card for increased access to in-person stores and ATMs

|

Use their card anywhere Visa Debit cards are accepted4

|

Access cash at ATMS around the world–over 48,000 of which are surcharge free5

|

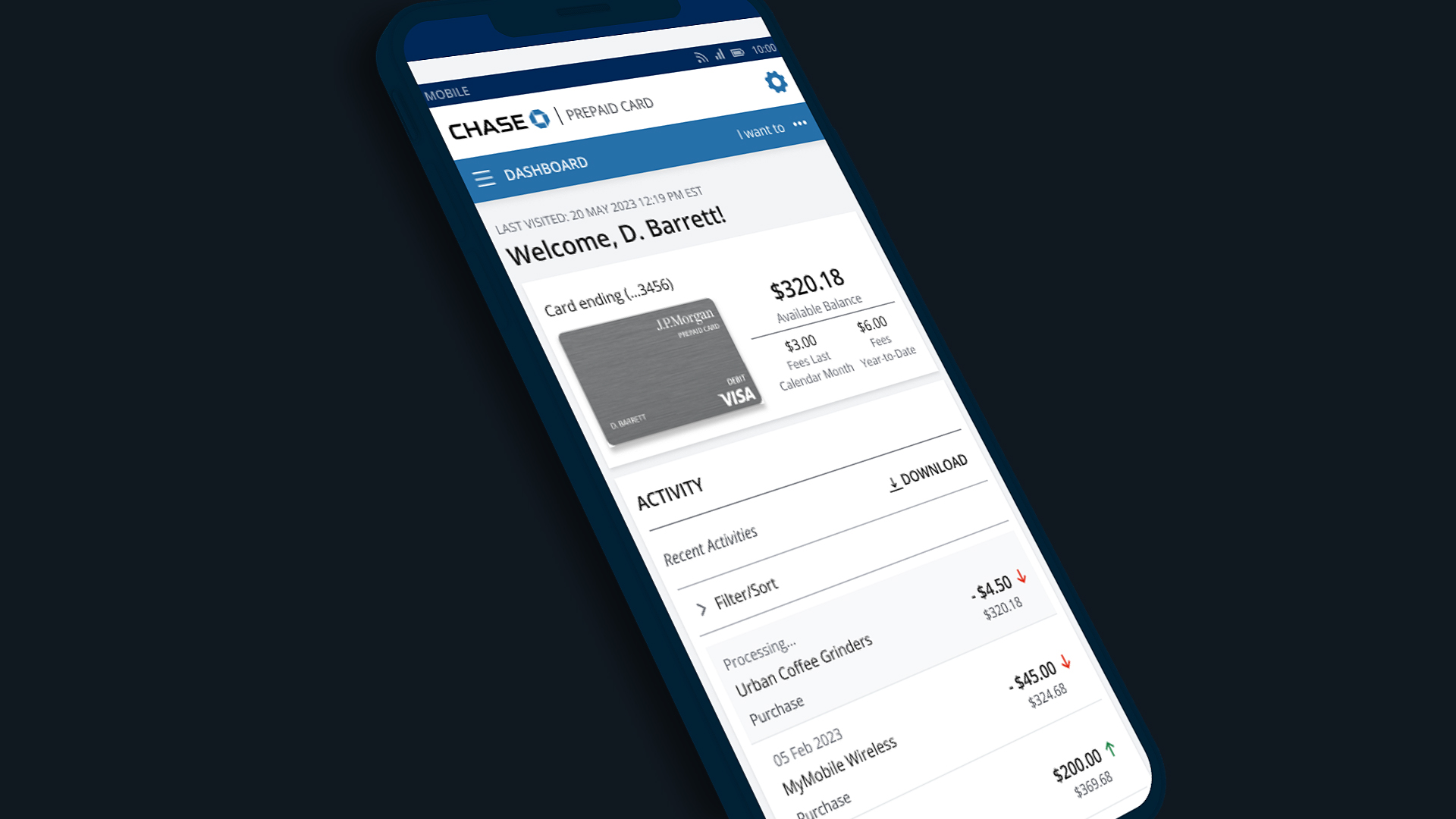

Streamline your payee experience with Prepaid Card

Simple. Cost effective. Digital or physical. Give your business a choice in your overall payment program—and give your customers, clients, and employees the flexibility they want—with Prepaid Card by J.P. Morgan Payments.

Offering a better payee experience

We can help you manage B2C payments across a variety of use cases—including consumer rebates and incentives, employee payments, and client refunds–so you can deliver a seamless payments experience.

Providing options with Prepaid Card

Offer your employees and customers prepaid cards for a variety of uses.

Payroll

Pay your employees faster with a Chase Payroll Card. They’ll receive payment with funds loaded onto their prepaid card instead of a paper check.1

Customers

Use for infrequent and one-time payments including manufacturer rebates, loyalty programs, retailer offers, refunds, loyalty rewards and promotions.1,2

Employees

Great for infrequent and ongoing non-payroll employee payments such as service awards, customer service, lead generation and thank you incentives.1

Delivering flexibility and convenience

Offering solutions for your payees

Digital Prepaid Card

- Card and funds are generally available in moments

- Retain the option to display the card in your app or our app

- Friendly with most mobile wallets6

- Real-time account management

Physical Prepaid Card

- Familiarity and convenience of a traditional Visa card

- Branded and custom card options

- Secure EMV chip where applicable

- Access ATMs globally

References

No bank account required.

Can issue digital or physical card options.

All features may not be present for all programs; features will vary depending upon program and use case need.

Cards are generally able to transact anywhere where Visa Debit cards are accepted. Certain restrictions may apply.

ATMs in the Chase and Money Pass Networks are surcharge free.

Wallet capability coming in 2024.

Certain products and solutions are exclusively offered to select business or commercial clients. Please be advised to consult with your banker to verify their availability. Additionally, it should be noted that new products are scheduled for launch and eligibility criteria may apply.